7 Things That Will Happen When the Economy Collapses

An economic collapse can take several forms, but most have a few things in common. Some start out as a prolonged recession that erodes the economic foundation over time. Whereas others, like the start of the Great Depression and the collapse of the Soviet Union, seemed to happen quickly. Even if the signs of eminent failure had been on the horizon for months or years in advance.

Looking at some of the historical economic collapses of the past helps us better see signs of a potential collapse coming. If anything, it helps us understand the signs leading up to an economic collapse, and how the financial dominoes will fall.

The Lead-Up to an Economic Collapse

History shows the same warning signs appearing again and again. Wealth steadily concentrates among a small elite, while a growing share of the population struggles to keep up with rising costs and stagnant incomes.

History shows the same warning signs appearing again and again. Wealth steadily concentrates among a small elite, while a growing share of the population struggles to keep up with rising costs and stagnant incomes.

During this period, the economy often looks healthier than it truly is. Easy credit, soaring national debt, and unchecked spending fuel short-term growth and mask deeper structural weaknesses. These conditions were present before the Great Depression and many other financial crises.

As these pressures accumulate, the system becomes fragile. One disruptive event is enough to trigger a rapid chain reaction that brings the entire economy down.

7. Stocks Plummet Toward a Crash

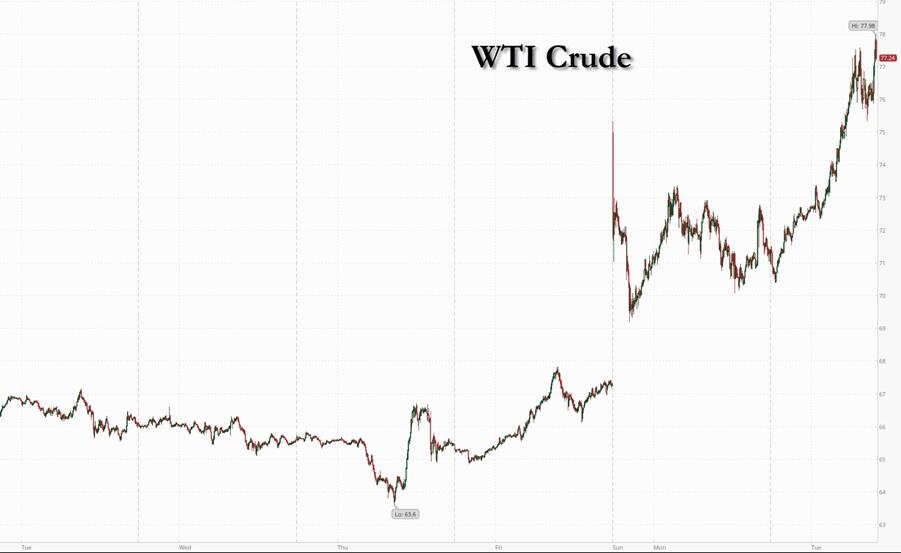

Modern financial markets are designed with safeguards meant to prevent a full-scale stock market collapse. Circuit breakers and trading halts can pause the bleeding, but they’re largely cosmetic.

The sudden drops that trigger them still ripple across the global economy, sparking automated sell-offs, rattling investors, and shaking public confidence. These forced pauses give financial institutions a brief window to adjust their strategies.

👉 The Only Legal Way to Stop Paying Your Taxes

In theory, this time is meant to stabilize markets. In practice, it often allows large players to reposition, by shifting risk, unloading assets, or tightening lending. All that could take place while smaller investors and everyday consumers remain exposed.

As a result, the real damage often shows up outside the stock market itself. Credit becomes harder to access, interest rates climb, layoffs increase, and consumer spending drops. Even if trading resumes without a crash, the economic strain continues to spread, weakening the broader economy and setting the stage for deeper financial trouble.

6. Financial System Under Strain

One of the earliest and most damaging effects of an economic collapse hits the banking system. As financial stress spreads, banks come under pressure from multiple directions at once. How this plays out depends on the severity of the crisis and the safeguards governments and regulators try to deploy.

The Banking System Under Pressure

As confidence erodes, a familiar pattern emerges: a modern-day run on the banks. People rush to pull money from savings and checking accounts, liquidate investments, and move whatever funds they can into cash. The goal is simple – maintain control over their money before access is restricted.

When withdrawals accelerate beyond what banks can handle, authorities often step in. Account freezes, withdrawal limits, and transaction delays are used to stop the bleeding. While these measures may stabilize banks temporarily, they can leave individuals unable to access essential funds when they need them most.

Here are 3 warning signs that your bank may be in trouble:

A Worsening Credit Crunch

In the early days of an economic collapse, banks and financial institutions often stay alive on “life support” because people still believe things will return to normal or settle into a “New Normal.”

But behind the scenes, lending starts to freeze – getting a loan or even a credit card becomes much harder, and this can happen even to people with strong credit scores.

The problem gets worse when the banks that survive tighten credit for businesses too. That makes it difficult for companies that are still trying to operate to pay for inventory, payroll, shipping, and day-to-day expenses.

If the hardest-hit sectors are tied to transport, manufacturing, energy, or imports, the credit crunch can spread fast and start disrupting the national supply chain.

The April 2025 tariff shock showed how quickly the system can swing: markets dropped hard and then jumped back within days, proving how unstable things can become and how risky it is to rely only on banks and the market.

That’s why President Trump knew how to be ahead of this. Knowing that sudden economic shocks can happen, he used his business experience to protect his wealth without relying on banks, even though he never spoke publicly about these strategies. You can learn more about how President Trump secured his wealth here.

5. Massive Unemployment Leading to Underemployment

As an economy starts to collapse, you’ll see sweeping unemployment, starting in luxury sectors, hospitality, and parts of the service economy.

As an economy starts to collapse, you’ll see sweeping unemployment, starting in luxury sectors, hospitality, and parts of the service economy.

This will be followed shortly after by manufacturing and production jobs being drastically cut as people stop spending money on consumer goods.

The massive spike in unemployment will cause serious desperation for families. The lack of available credit will further exacerbate things. Especially for people who couldn’t get their funds out of the banks before their accounts were frozen.

The Federal Government might be able to extend unemployment benefits in the short term. Yet as the economy continues to degrade, any benefits are going to degrade as the US borrowing power starts to evaporate.

Historically, we see what this kind of severe, prolonged unemployment looked like during the Great Depression. All over the world people would stand in line waiting for any job they could find. If one man gave out while digging a ditch, someone from the line would rush out to take his place.

Desperate unemployment gives way to ugly forms of under-employment. People who are willing to do anything to keep food on the table soon become desperate enough to do anything they need to survive.

4. Government Debt Default

The Federal Government usually responds to an economic downturn by increasing spending and rolling out stimulus programs. The goal is to inject money into the economy to slow the collapse and buy time for policymakers and businesses to plan a longer-term recovery.

Unfortunately, there’s a point where no amount of spending can keep an over-leveraged economy from collapsing, especially when political tensions lead to filibusters and blockades that prevent funding.

Eventually, the Government gets to the point where it can no longer make its minimum debt payments and defaults on the national debt. The impact of this on global markets, as well as the already strained financial sector and banking system, will be a crippling blow.

3. Currency Devaluation

As the value of the dollar plummets in the face of an economic collapse, hyperinflation rears its ugly head. Historically, this is something that occurred in Germany after World War One, which eventually led to the collapse of the Weimar Republic. Suddenly, you have things with exorbitant prices, like when a simple German stamp to mail a letter was 1 billion Marks.

This level of hyperinflation suddenly means that the $20 bill hidden under your mattress is worth next to nothing. All the people you elbowed past at the ATM to withdraw your funds before the asset freeze was triggered were for nothing.

It makes it incredibly hard to afford everyday items. If you live in an urban area, this can mean the only way you get what you need is by taking it. On the other hand, if you live off-grid, things can be better when you return to bartering and do your best to become self-sufficient.

But bartering is an art, and nowadays not many people know how to do it. The Amish do. For hundreds of years, they’ve managed money outside modern financial systems. Here’s what they do differently:

2. Expansion of Emergency Powers

As economic pressure intensifies, public order begins to fracture, forcing authorities and communities to respond in increasingly extreme ways.

Martial Law Being Declared

At some point in the economic collapse, the government will need to declare martial law in hotbed areas. This includes urban areas where riots and crime are out of control. However, the military uses a broad-sword approach to dealing with crime, rather than the scalpel of local law enforcement.

👉The First Thing You Should Do When Martial Law Is Declared

While martial law might quell civil unrest in hot zones, the reaction to how they deal with crime and people en-masse can spark fury elsewhere. People in areas that aren’t under martial law will protest. Military intervention. Leading to widespread problems in areas where there previously weren’t any.

Don’t make the mistake of thinking that martial law breaking out in a distant city won’t impact your safety personally or politically!

High Crime Rates & Civil Unrest

When an economy collapses, the rule of law usually goes with it. People who are desperate for money, who can’t earn it, will easily turn to petty theft, and even grand larceny. Crime rates and retaliation from victims can easily spill over into neighborhoods.

When an economy collapses, the rule of law usually goes with it. People who are desperate for money, who can’t earn it, will easily turn to petty theft, and even grand larceny. Crime rates and retaliation from victims can easily spill over into neighborhoods.

The government being unable to respond to the collapsing economy will only escalate things.

This leads to civil unrest and recurring riots that many will use as a license to steal. Especially when riots break out near shops, malls, and places of business housing valuable items.

As a result, in urban areas, riots, property damage, and loss of life could reach frightening levels. For those living in a city, they may be forced to either shelter in place or bug out.

If you live in a rural area, bugging-in could be your safest move. If you still didn’t get your remote home ready, then our advice is to start now – this Navy SEAL reveals the best way to do that. You should make sure your house is ready, because civil unrest can lead to an influx of displaced people into rural and remote areas. So much “stranger danger” can spark trouble in places that were once peaceful but are now surviving on very little.

1. Currency Redenomination

Assuming the government remains functional after an economic collapse, the only way to deal with hyperinflation and the devaluation of currency is through redenomination. It’s a process of changing the face value of the existing currency by introducing a new unit of currency.

In some cases, like Turkey’s redenomination of 2005, they simply hack a few zeroes off the end and start over. Essentially, the reset button is pressed and $1,000 is worth $1. However, the USA is a world economic superpower, and the dollar is the universal global currency.

👉 Are You a Senior? Here’s How to Protect Your Savings During the Next Crisis

Redenomination after hyperinflation would have a devastating effect on the US economy and global markets. Confidence in our currency would sink to a historic low, impacting consumer prices as well as worldwide lending policies.

The dollar would stop being the globally recognized universal currency. The Yen or Euro might become the new primary unit of trade. Thus, further hampering the US presence in global markets, possibly leading to an extended period of economic isolationism.

You already have food, water, and power covered. That’s the easy part.

The real problems begin when shortages last longer than expected. People don’t stay put. They start driving back roads, cutting across properties, and checking places that look quiet or lightly defended. Rural areas stop being invisible.

So, if your plan is to stay where you are, you need ways to create space, signal boundaries, and shut down situations early – before they turn into confrontations you don’t want. Strategies that help you manage distance and discourage escalation give you time, and time keeps small problems from becoming permanent ones.

The Anti-Looter Kit fits into that part of a plan.

It works quietly in the background, ready when your home or your safety is at risk. Because threats don’t wait for some big collapse. They can happen on a normal day – while you’re home, stepping out for errands, or gone for a short time.

Protection starts with having the right tools in place ahead of time. The Anti-Looter Kit was built for that purpose. Designed for safety, reliability, and peace of mind, it’s one of the strongest options available on the market.

And right now, it also comes with two free survival gifts and a discount that you cannot miss – but only for a limited time!

Click below to get the Anti-Looter Kit today and secure your home the smart way – even when life gets unpredictable:

Final Thoughts

Economic collapse is not a singular event that arrives, destroys everything, and then politely leaves. By the time the word “collapse” feels appropriate, most of the damage has already been normalized, explained away, or dismissed as temporary turbulence.

The pattern rarely changes. Institutions move first to secure themselves, liquidity concentrates upward, and new restrictions appear under the banner of stability. As the system tightens, responsibility is quietly shifted onto individuals, leaving those affected to be blamed for circumstances they never controlled.

I cannot stress this enough – the real divide created by an economic collapse is not rich versus poor, but prepared versus exposed. The difference is decided long before the word “collapse” ever makes the headlines.

You may also like:

Why an EMP Attack Is Actually Worse Than You Think

Why an EMP Attack Is Actually Worse Than You Think

This Could Send America Back to the Dark Ages (VIDEO)

10 Secret Signs Your Neighbor Is A Fed

You Caught a Looter on Your Property. Now What?

The Survival Shelter They Don’t Want You To Know About

Read the full article here