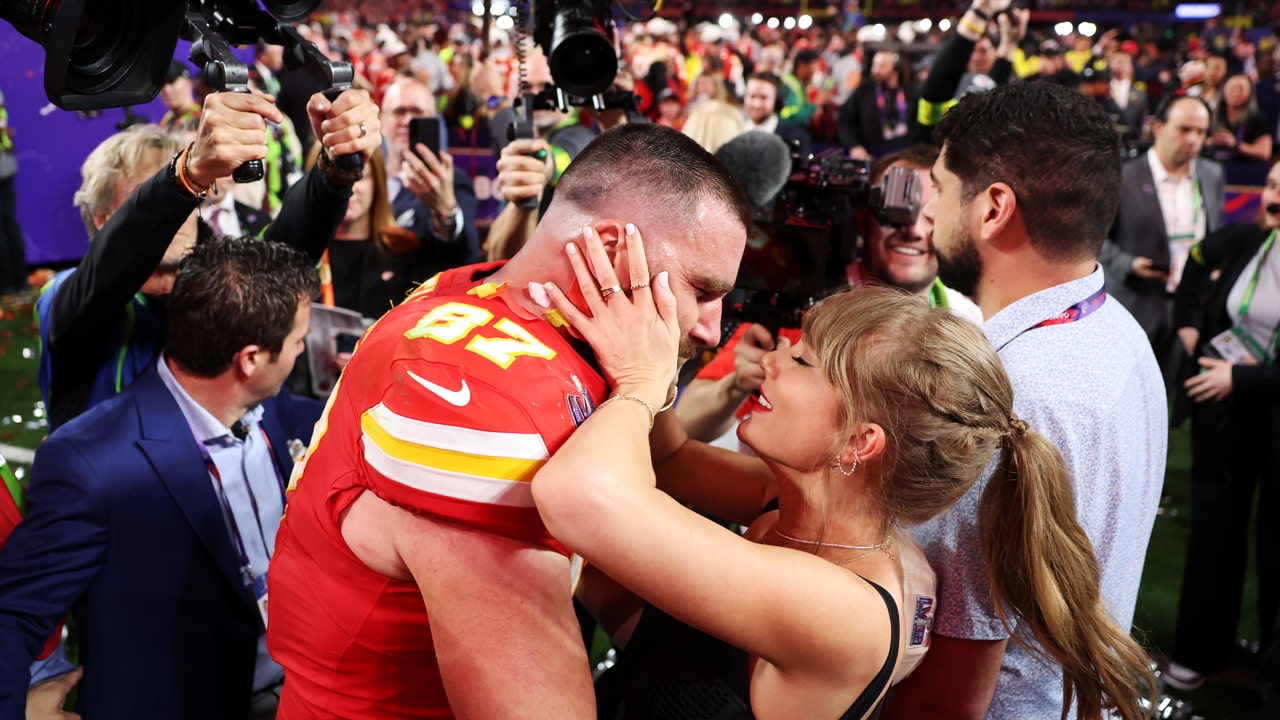

Taylor Swift and Travis Kelce engagement news highlights hidden tax burden on everyday entertainment workers

NEWYou can now listen to Fox News articles!

What do Taylor Swift and Travis Kelce have in common? It’s obvious. They represent the unluckiest pair of occupations when it comes to dealing with state income taxes.

They also just got engaged. But significantly more importantly, they fall under the two categories of individuals subject to “jock taxes,” an informal term for rules requiring professional athletes and entertainers to file tax returns in every state they work in, even when they fly in on the Kansas City Chiefs’ team airplane in the morning and leave on Taylor Swift’s private jet at night.

Now, before you shed too many tears for the happy couple, it’s unlikely that either Swift or Kelce has filed their own taxes in many years. Neither the gridiron nor the stage has ever been deprived of either’s presence because they were too busy figuring out how to credit taxes paid to another state against their home state’s tax liability.

But jock taxes apply to more than just mega-celebrity lovebirds. While Swift and Kelce are busy counting zeroes on their paychecks, many people of far more modest means who make what they do possible are expected to file just as many tax returns as Swift and Kelce are.

THE LEFT SAID MARRIAGE WAS DEAD. TAYLOR SWIFT JUST ENDORSED IT WITH HER OWN ‘LOVE STORY’

That’s because the definitions of “professional athletes” and “entertainers” are far broader than one might assume. Other, less noticeable individuals on the football field, such as the junior trainers bringing Kelce his Gatorade or massaging injuries, often earn salaries well below the national median.

And while Swift is known for doling out generous bonuses to her staff, all entertainers’ jobs are made possible by a posse of production employees, background talent, security personnel, drivers and so on, most of whose salaries would be familiar to the average American. All this traveling support staff face the same requirements to file in multiple states as Kelce and Swift.

SYDNEY SWEENEY JEANS CONTROVERSY MAKING ADVERTISING GREAT AGAIN

Beyond that, plenty of professional athletes and entertainers are not making the eye-popping incomes that Kelce and Swift are – Major League Soccer players can earn as little as $80,000, WNBA players’ salary floor is $66,000 for 2025.

Worse, minor league athletes are lumped into the “professional athlete” bucket. A 2022 study found that more than half of all minor league baseball players had to take a second job. For entertainers, it likely goes without saying that merely having a job performing in front of an audience is by no means a guarantee of wealth. Nevertheless, they all face the same requirements to file a tax return in each state they play in.

For taxpayers with incomes that do not require two or more commas, having to file in many states costs not just time and exasperation, but also money. Adding an additional state to a TurboTax return can cost as much as $65, which translates to a serious hidden tax when multiplied by double-digit numbers of states. The numbers of starving artists, minor leaguers, trainers and production staffers facing these kinds of burdens far outnumber the Travises and the Taylors of the country.

The solution is to narrow these over-broad definitions regarding who has to pay jock taxes, making sure they apply to Travis and Taylor and not the average Joe and Jane. States are often hesitant to tinker with their jock taxes out of the mistaken belief that taxing visiting athletes and entertainers generates huge amounts of revenue, but that’s not really the case.

CLICK HERE FOR MORE FOX NEWS OPINION

One study in March 2020 estimated that the total lost jock tax revenue, across all states, from potential pandemic-related cancellations of the remaining NBA, NFL and MLB games in 2020, would be $295 million – or 0.1% of total income tax revenues alone in the 20 affected states and D.C.

So if states want to send Travis and Taylor an engagement present, they don’t need to direct it to the happy couple. They should send it instead to the average taxpayers who are caught in the crossfire of the state tax compliance nightmare that is meant for the nation’s highest-profile fiancés.

Read the full article here