LAWLESS: Illinois County Defies Court, Vows to Continue Collecting Gun & Ammo Tax

A half-score of years ago, Illinois’ most aggressive gun rights group Guns Save Life a lawsuit challenging Cook County’s (then) new gun and ammunition tax. Following those 10 years in the courts, we have two orders from Illinois Courts— including the Illinois Supreme Court—saying the ordinance establishing the tax was and remains unconstitutional. Yet, Cook County officials have told us in recent days they have no intention of ceasing collection of these (unconstitutional) taxes. Welcome to the lawless Windy City.

I work as the Guns Save Life Executive Director for my day job. To this day, I vividly remember the deposition I underwent for this legal challenge at the Cook County building in downtown Chicago. It felt like an old cop show from the 1970s with grungy walls, bare lightbulbs, cold metal desks and uncomfortable chairs. The first meaningful question, “What’s your wife’s favorite gun and why?”

“A Colt Commando .38 snubnose because she likes it best, I guess,” I replied.

The deposition went on for hours. Supposedly they didn’t have a bottle of water because of budget constraints so they brought me a miniature disposable cup of lukewarm water that they’d filled from the bathroom. (I didn’t ask if they got the water from the faucet or … elsewhere.) And while I couldn’t bring a handcuff key into the building at the security checkpoint (they aggressively seized my keys), they handed me an 18-inch wooden bat with the bathroom keys attached when I asked to use the facilities. Makes perfect sense from a security standpoint, right?

The case moved through the courts at a snail’s pace, with the the Cook County Circuit Court and the First Appellate Courts both ruling that the targeted tax on a fundamental right doesn’t run afoul of U.S. Supreme Court precedent or the Second Amendment. This despite landmark civil rights cases including Harper v. Board of Elections (poll tax) and Minneapolis Star-Tribune v. Commissioner (tax on printer’s ink).

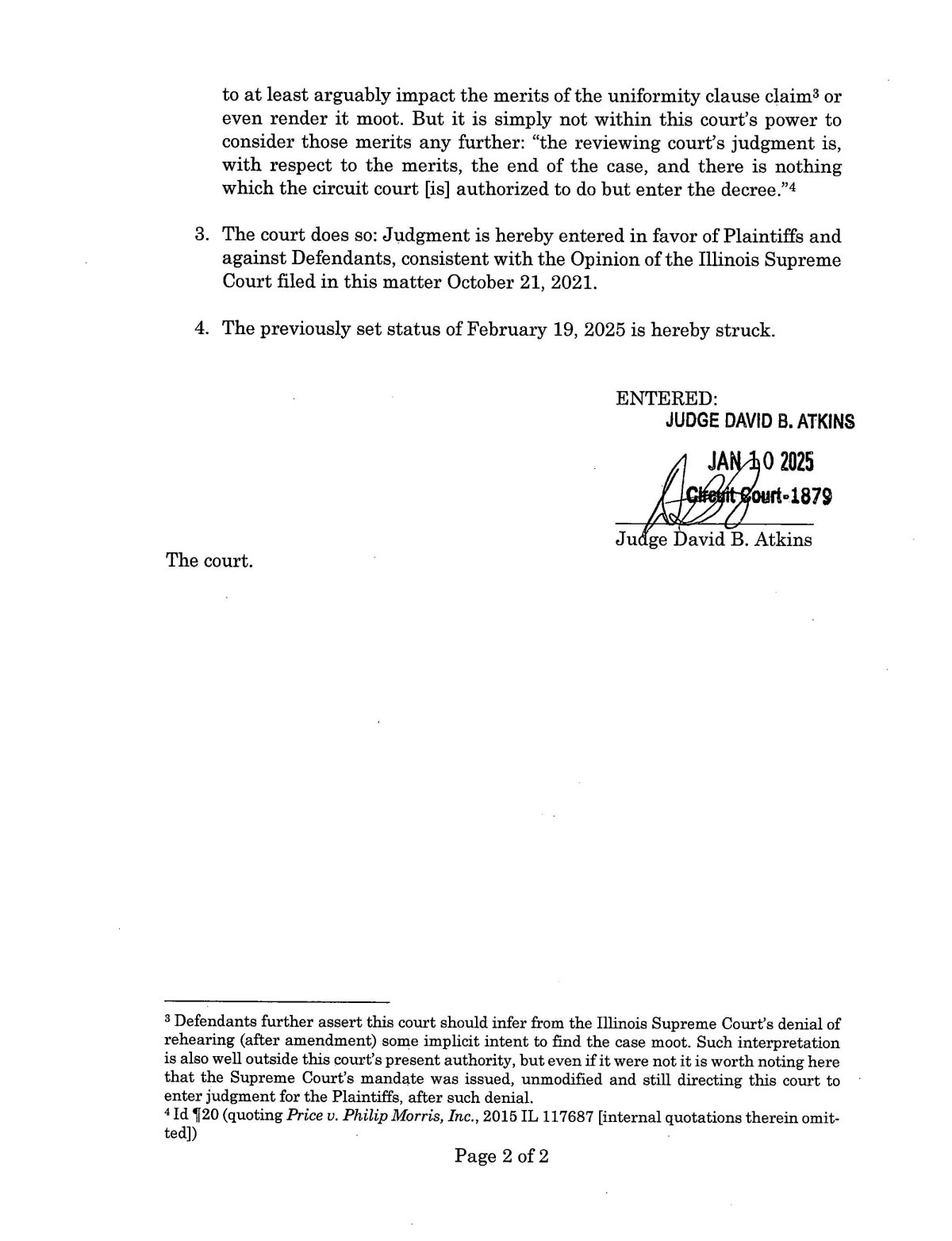

We appealed to the Illinois Supreme Court who, in 2021, reversed the lower courts and ruled the tax ordinance violated the Uniformity Clause of the Illinois State Constitution. (The Illinois Supreme Court sidestepped 2nd Amendment considerations…) As part of that decision, they remanded the case back to the trial court to issue an order for a summary judgement in favor of Guns Save Life.

Cook County’s Board passed an amended taxing ordinance, claiming they remedied the deficiencies cited by the Illinois Supreme Court. Then they boldly moved to have our entire case thrown out after the Illinois Supreme Court had ruled in our favor. That’s chutzpah.

For four years the case has languished, but finally on January 10th, a Cook County Circuit Judge finally did what the Illinois Supreme Court ordered.

Fast forward a few days. Our side contacted the Cook County officials asking about a plan to end the collection of the taxes in an orderly manner.

Cook County’s response, in so many words: “We have no intention of ending the collection of taxes on gun and ammo sales in Cook County.”

There you have it.

A clear breakdown of the rule of law in Cook County, Illinois, and a story that is surely to be continued…

Read the full article here